Whitechurch Investment Update: Quarterly Review - Q3 2022

14th October 2022

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

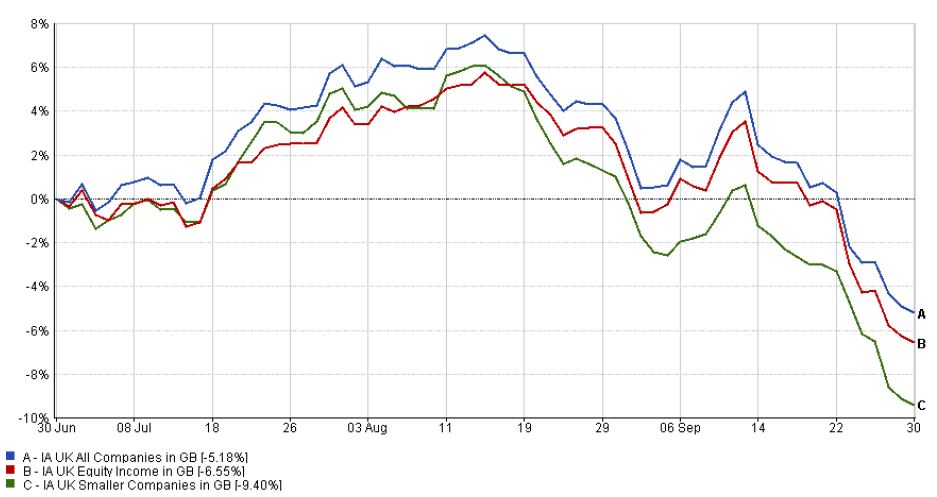

UK Equities

In what was a tumultuous quarter for the UK economy, UK equities delivered a return of -3.5%. In a repeat of the previous quarter, large cap stocks proved most resilient, retreating 2.7%, while the more domestically orientated mid and small caps fell 7.3% and 4.9%, respectively. Once again, mid-cap stocks were the most volatile segment of the market – by Q3 end, the index was down 25.3% year-to-date. After a lacklustre Q2, energy stocks were amongst the strongest performers in Q3 (8.4%), buoyed by the elevated price of natural gas. The UK market was also supported by positive contributions from technology (8.1%) and consumer staples (0.3%). All other sectors retreated over the quarter – notable laggards were telecommunications (-21.6%), real estate (-19.0%) and healthcare (-12.7%).

Following a disappointing first half of 2022, UK equities rallied in July, with some of the most notable gains within the consumer discretionary and industrial sectors. Data released later in the quarter showed that the UK economy grew 0.2% through July. The more general appetite for risk assets was supported by news from the US, where July’s falling Consumer Price Index (CPI) was taken as the first sign that the world’s largest economy may have passed peak inflation. In the UK, too, inflation appeared to slow, with August’s CPI coming in at 9.9%, down from 10.1% the previous month. But with the next energy price cap increase expected on October 1st, upwards inflationary pressures are still expected in the medium-term. Following a string of scandals, July also saw the resignation of Prime Minister Boris Johnson, prompting a summer leadership contest among high-ranking Tories.

Early August saw a continuation of July’s trend, with both equities and bonds making gains against an unsettled political backdrop. On the 9th, the Bank of England (BoE) issued a bleak forecast for the UK economy, predicting 13% peak inflation, a 2% fall in GDP and a five-quarter recession the onset of which the bank expects in Q4 of this year. This, along with more immediate concerns about inflation and the trajectory of the BoE’s interest rate rises, resulted in a gradual erosion of positive sentiment through the latter half of August, while a reaffirmation from the US Federal Reserve (Fed) that it would stick to its aggressive hiking policy weighed on developed markets more generally.

Politics came back to the fore in September, with Liz Truss elected as Prime Minister. The energy price guarantee, her first major policy commitment, set out a plan to cap the average household energy bill at £2,500. The cap will likely limit the rise in inflation this winter, albeit at a significant cost to the taxpayer, with some analysts predicted that the 2-year plan might cost upwards of £160bn should the price of gas remain elevated. While the energy guarantee was broadly welcomed, the ‘mini budget’, announced by Chancellor Kwasi Kwarteng a week later, was anything but. Key features included a freeze on corporation tax and lifting the cap on bankers’ bonuses, while a plan to scrap the additional tax rate for high earners proved particularly unpopular. Taken together, the mini budget was widely seen as adding to existing inflationary pressures, which will likely force the BoE to move higher and faster on interest rates. The result was a pronounced sell-off of UK equities and bonds, while the pound slumped to a record low against the dollar, falling as low at $1.03 before recovering some ground to finish September at $1.12.

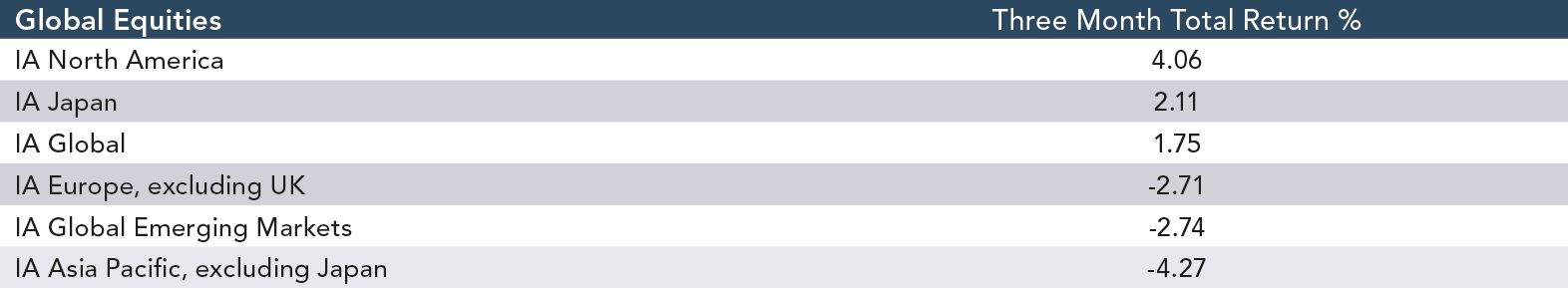

Global Equities

Global equities faced an array of headwinds through Q3, including interest rate hikes, geopolitical tension and extreme weather events. Citing these shocks, and subsequent fears of a global recession, the International Monetary Fund (IMF) lowered its forecast for growth in 2022 to 3.2%, 0.4% lower than in its April outlook. With the impact of disinflationary monetary policy yet to bite, forecast global growth in 2023 was also revised down. Despite the gloomy economic outlook, aggregate global equities finished Q3 in the black, gaining 3.4%.

The US was the best performing major region over the quarter, as strong July gains for the main technology-laden indices offset losses later in August and September. The quarter began with the world’s largest economy entering a ‘technical recession’ – that is, two consecutive quarters of negative GDP growth. US GDP shrank by 0.9% in Q2, following hot on the heels of a 1.6% contraction in Q1. However, a US recession can only officially be declared by the National Bureau of Economic Research (NBER), and it declined to do so. Alongside GDP, NBER looks at employment figures, industrial production and other factors, many of which continued to surprise on the upside throughout the quarter. Non-farm payrolls data showed that 528k jobs were added in July, compared to market expectations of 250k. At the same time, inflation appeared to pass its peak, with July’s CPI coming in at 8.5%, down 0.6% month-on-month. The prospect of receding inflation, and anticipation that the Federal Reserve (Fed) would pivot to a more dovish (favouring lower interest rates) stance, buoyed investor sentiment throughout July and into early August. Growth stocks, which have underperformed their value counterparts year-to-date, saw a particularly strong rally. In August, President Biden signed the Inflation Reduction Act. While some questioned the impact the bill will ultimately have on inflation, it provided a boost for ‘green’ assets, as well as a much-needed legislative win for the Democrats in the build-up to the November mid-terms.

The Q3 rally ended abruptly in late August, courtesy of remarks from Chair of the Fed, Jerome Powell. During a brief keynote at Jackson Hole, he reiterated that price control would remain the Fed’s number one priority, dashing hopes of a policy shift. According to its own forecast, the Fed now expects to raise rates as high as 4.6% in 2023. August’s inflation reading came in above expectations at 8.3%, with core CPI proving particularly sticky, reaffirming Powell’s hawkish (favouring higher interest rates) rhetoric and weighing on sentiment throughout September.

European equities lost ground over the quarter, retreating 2.6%. Despite a series of major setbacks, Putin showed no sign of relenting on his war aims in Ukraine, instead doubling down with a ‘partial mobilisation’ of Russian conscripts, and sham referendums in occupied regions. Russian natural gas flows to Europe through Nord Stream 1, already greatly reduced in response to sanctions, were officially reduced to zero in early September. While originally citing maintenance issues, operator Gazprom eventually confirmed the pipeline would remain closed until sanctions are lifted. The resultant soaring cost of energy was compounded by a record-breaking drought, with falling river levels contributing to a fall in output from the French nuclear fleet and limiting coal transport along the Rhine. Against this backdrop, inflation reached a record high of 9.1% in August, prompting the previously dovish European Central Bank (ECB) to raise rates by 75 basis points in early September. Europe’s manufacturers continued to feel the pinch of high energy prices, with projections for September showing Eurozone production output falling for the fourth straight month.

Japanese equities were the second-best performing region over the period. As in previous quarters, the historically cyclical market broadly followed the pattern emerging in the US, with gains in July/early August and losses in September. Alongside anticipation of a policy shift by the Fed, performance in the first half of August was driven by strong quarterly results. Although profit momentum slowed from Q2, overall results were again ahead of expectations. Investors were equally encouraged by signs that Japanese inflation may be becoming entrenched at a moderate but sustainable rate, following decades of deflation – August’s CPI came in just above consensus at 2.8%. In response, the Bank of Japan reaffirmed its commitment to its current ultra-loose monetary policy.

Chinese equities were the worst performing region through Q3, retreating 14.6% on aggregate. Like in Europe, the country found itself at the mercy of the weather, with a record-breaking drought causing a material decline in hydroelectric output. Consequent electricity supply concerns led regional governments to enforce factory shutdowns across large swathes of China’s industrial heartland, reducing output. Meanwhile, problems in the property sector continued to spread, and a rise in the number of Omicron cases led to lockdowns in several major cities. Against this backdrop, economic data was mixed. Data released in July showed that the rate of growth in Q2 was the slowest since Q1 2020, however exports in June were up 17.9% year-on-year. Total export value grew again in July, before falling in August. In a bid to counter underwhelming domestic demand, the People’s Bank of China continued to ease monetary policy, while on the geopolitical front, a controversial visit to Taiwan by US Speaker of the House Nancy Pelosi prompted China to retaliate with a massive military exercise. The show of strength, during which Chinese forces effectively encircled Taiwan, were considered by many as a dry run for potential future re-unification.

Largely due to the inclusion of China in the Emerging Markets index, the asset class was among the weaker performers in Q3, despite strong gains from several other constituents. India was amongst the standout economies, with falling fuel prices and improving macroeconomic data supporting equity returns – Indian inflation fell from nearly 8% in Q2 to 6.7% in July, before rising slightly again in August. However, at 7%, inflation is now only slightly above the long-term target of 6%. Net energy exporters, such as Saudi Arabia, Qatar and UAE all outperformed despite weakening energy prices. China aside, heavily coal-dependent Poland was the notable detractor in Q3, following its decision to ban Russian imports.

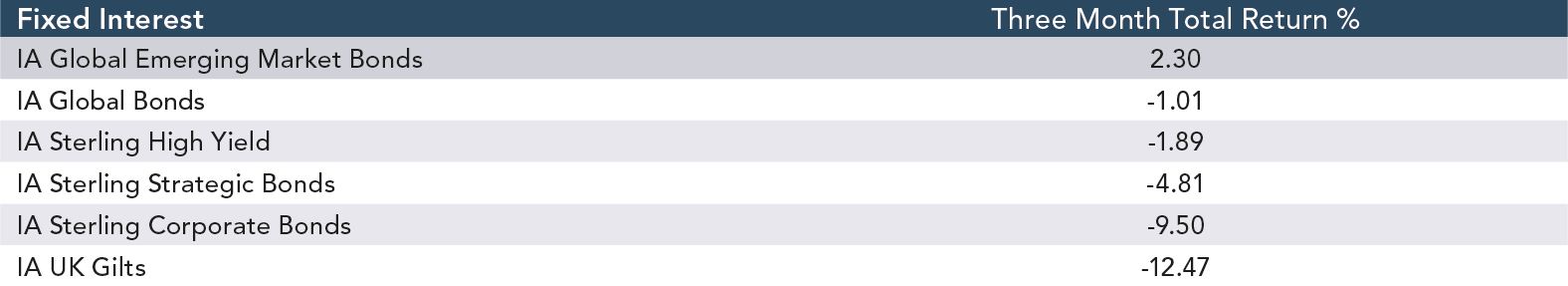

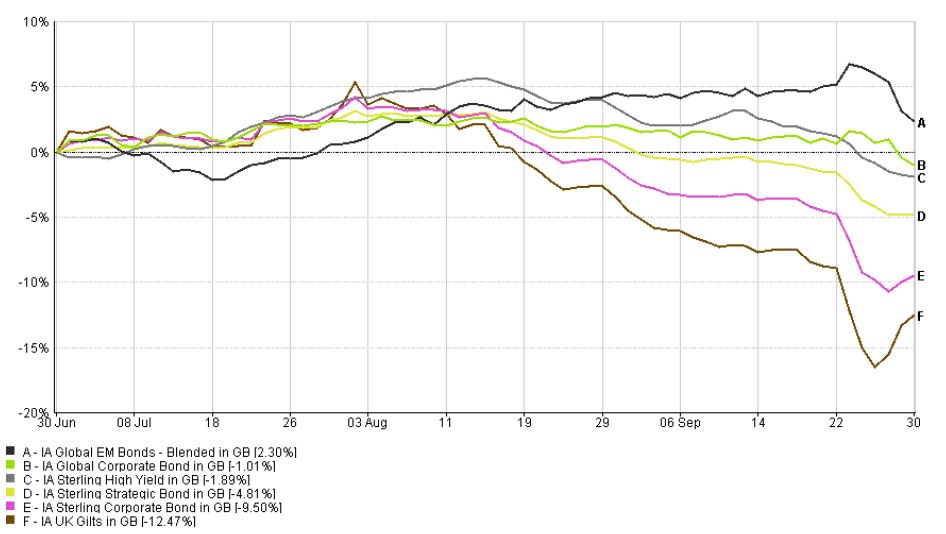

Fixed Interest

Q3 proved to be yet another volatile quarter for bonds, with fixed income assets typically tracking movements in the equity markets. Through July and early August, hope of a dovish pivot by the Fed gave some reprise for bond investors, with yields briefly falling. However, persistent inflation and Jerome Powell’s Jackson Hole remarks put pay to any sustained rally, with yields once again rising in late August through September. Despite retreating in July, the yield of the US 10-year Treasury finished the quarter almost 100 basis points higher, at 3.83%, with its two-year counterpart more than 140 basis points higher, at 4.28%. A higher yield on the 2 year (versus longer maturities) is indicative of the market view that there is greater risk to the economy in the short-term. The Fed followed its 75 basis point hike in June with a further two 75 basis point increases in July and September. The latter came hot off the heels of the August’s inflation data, prompting (now unfounded) fears of an even larger 100 basis point hike.

Back on this side of the pond, movements in the gilt market were even more dramatic. The yield on a UK 10-year gilt had already risen 140 basis points prior to the Chancellor’s mini-budget announcement. Concerns that a low tax regime will exacerbate inflation and force through an even greater number of rate hikes caused further turmoil, with yields on the 10-year rising nearly 100 basis points in the days after the speech. At one point, soaring yields on long-dated gilts even threatened to destabilise the UK’s liability-driven pension sector, forcing the BoE to intervene by announcing a new program of long-dated gilt purchases. The move, expected to cost in the region of £65bn, signalled a forced return to quantitative easing just weeks ahead of the expected onset of quantitative tightening, which now looks increasingly unlikely. In the calm before the storm, the BoE instigated two further 50 basis point rate rises, one in August and another in early September. As highlighted above, the previously dovish ECB followed its 50 basis point hike in July with a further 75 basis point increase in September, saying that further rises would be required to calm inflation that is ‘likely to stay above target for an extended period’.

On aggregate, global government bonds marginally outperformed corporate bonds over the quarter, despite the notable underperformance of UK gilts. In sterling and dollar denominated debt markets, shorter duration assets continued to outperform their long duration counterparts in the face of continued and significant interest rate rises.

Commercial Property

In the UK commercial property market, Q3 produced the first negative quarterly return in nearly two years. Anticipation of further rates hikes (and the knock-on effect on borrowing), as well as the squeeze on household incomes impacting expected retail demand, both weighed on sentiment. As in previous quarters, listed Real Estate Investment Trusts (REITs) were amongst the worst performers, as they continued to be negatively impacted by volatility in the wider market. Despite the worsening macro-outlook, lagging indicators remained mixed. Having turned briefly negative in June, office rental value grew in July, increasing 0.11%, while in the industrial market, investment volumes stood at £18bn in the year to June 2022, well above the £7.7bn figure for December 2019. Positive news in the office and industrial sectors was offset by retail, where the squeeze on household incomes began to bite. UK retail footfall fell 14.2% in July, compared to 2019, while shopping centres saw an even greater fall of 19%. Rising rates also began to have a negative impact on the UK housing market, with the average house price falling 1.3% in August. In late September, upheaval in the wake of the Chancellors’ mini-budget, and forecasts that the BoE base rate could reach almost 6% as a result, led several providers to withdraw previously offered mortgage deals, with analysts now predicting a significant decline in UK house prices in 2023.

Commodities

Q3 saw a continuation of year-to-date volatility. Viewing the asset class as a whole, the composite index fell 2.42% over the quarter, with the most notable losses felt towards the end of September. The period was characterised by a number of supply shocks, not least in the energy markets. European natural gas prices soared to 339 EUR/MWh in late August, exacerbated by a record drought and scheduled downtime at a number of French nuclear reactors. Further bad news for European energy security came in early September when, following months of reduced flow, Gazprom officially announced the indefinite closure of Nord Stream 1, leading to a spike in global coal prices as governments scrambled for alternative sources of energy. In the absence of Russian exports, European countries turned to the US and the Middle East, paying heavy premiums for cargoes of liquified natural gas (LNG). This, as well as effective demand destruction measures, saw EU inventories climb to 88% storage capacity by the end of September. With a renewed optimism for European energy security, gas prices fell significantly towards the end of Q3, despite the reported sabotage of both Nord Stream pipelines in the final days of the month.

The price of Brent crude oil fell almost 25%, finishing Q3 at 85 USD/Bbl., as markets moved to price in a global economic downturn. Russia, the world’s third largest exporter, offset reduced demand from Europe by boosting exports to China and India, albeit at a heavy discount. In the agricultural markets, a deal struck in late July saw ships resume exports of grain from southern Ukraine. Despite this, the price of wheat rose again through Q3, with Putin vowing to revise the original deal having stated that Russia felt ‘cheated’. Key industrial metals, including iron ore, aluminium and copper all fell as recession concerns dampened expectations of future demand. The price of precious metals, including gold, also fell, as the resilience of the US economy and strength of the dollar made the currency a more attractive safe-haven asset.

Cash

Given the economic backdrop and the resultant upward move in fixed income yields, the case for holding cash relative to bonds continued to strengthen over the quarter. In the short-term, cash deposits insulate investors from the price volatility seen in other asset markets. However, in the long-term, the real value of cash deposits is likely to continue to be eroded by inflation. We currently only hold cash for short-term tactical reasons or within lower risk strategies, where the risk profile dictates a need for a larger cash allocation.reasons or within lower risk strategies, where the risk profile dictates a need for a larger cash allocation.

Whitechurch Investment Team

Quarterly Review, Q3 2022

(Issued October 2022)

FP3445.11.10.2022

Click here to download a PDF Version of the Quarterly Review

Source: Financial Express Analytics. Performance figures are calculated from 01/04/2022 to 30/06/2022 net of fees in sterling. Unit Trust prices are calculated on a bid-to-bid basis OEICs, Investment Trust and Share prices are calculated on a mid to mid basis, with net income reinvested. The value of investments and any income will fluctuate and investors may not get back the full amount invested. Currency exchange rates may affect the value of investments.

Important Notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.