Whitechurch Investment Update: Quarterly Review - Q2 2023

10th July 2023

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

Inflation was once again front and centre for investors and policymakers alike through the second quarter of 2023. While US inflation continued its steady downward trajectory, in the UK three consecutive upside surprises piled further pressure on the Bank of England (BoE) as it struggled to keep prices in check. Elsewhere, the big theme was the resurgence of so-called growth stocks and in particular, the outperformance of large cap technology stocks. Nvidia, the US listed Graphical Processing Unit (GPU) manufacturer, hit the headlines in mid-May, as strong earnings saw its share price gain over 20% in a single night of after-hours trading and lit the touch paper on the latest round of excitement about the future potential of Artificial Intelligence (AI).

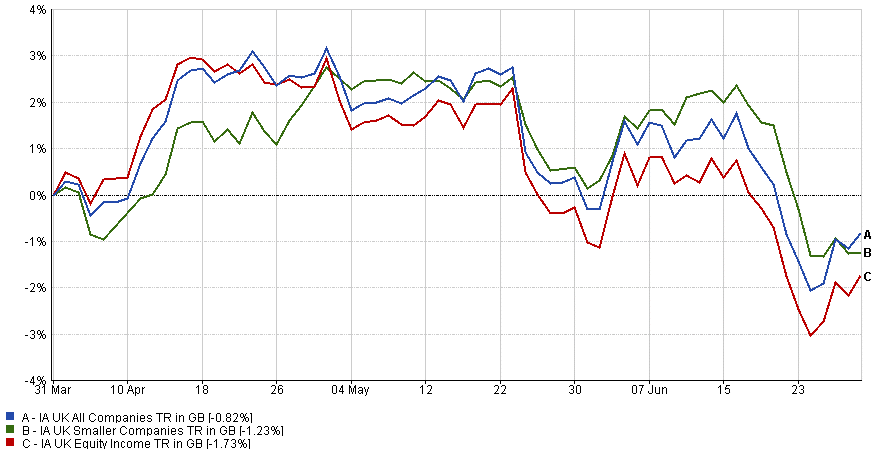

UK Equities

Following a broad rally in early April, it proved to be a challenging quarter for the UK market, with all major indices finishing in the red. Large-cap stocks were the worst performers on aggregate, weighed down by persistent inflation, disappointing economic data from China and the falling price of oil. Much has been made of the make-up of the UK market, with the large-cap index in particular comprising of many ‘old world’ stocks such as commodity extractors, tobacco companies and big banks. Whilst such sectors were amongst the best performers through an exceedingly volatile 2022, the lack of UK-listed technology companies has proven a significant headwind to the UK market year-to-date.

UK equities began the quarter in positive territory, recording solid gains through April. The lion’s share of these gains came in the first half of the month, driven in large part by the financial sector, as fears that a series of failures in the US regional banking system could spill over into a more global crisis waned. Inflation has been a dominant theme through much of the last 18 months, both in the UK and globally. Sadly for reader and writer alike, the second quarter of 2023 offered precious little respite, with the UK suffering from a string of disappointing inflation figures. At time of writing, UK inflation is higher than any other G7 economy.

April’s Consumer Price Index (CPI, published in May) was particularly disappointing. While on the face of it, a fall from 10.1% to 8.7% year-on-year represented a significant decline, expectations were for a far steeper fall to 8.2%, as the base effects of last year’s spike in energy prices fell out of the 12-month data. Offsetting the negative contribution from energy was very strong positive contribution from food and drink prices, which rose 19.1% year-on-year, despite some suggestions from major retailers that the wholesale price of staples, such as milk, are beginning to fall.

More bad news was to follow in June, with May’s inflation reading showing no change versus the previous month. This dashed previously growing hopes of a more dovish (generally favouring lower rates) stance from the BoE, as it became apparent the battle to tame inflation is far from over. Analysts are now predicting that UK rates could peak as high as 6.5% by the end of 2023, placing significant further strain on UK borrowers. High inflation is also problematic for Rishi Sunak’s conservative government, with the Prime Minister promising to halve inflation by the end of the year ahead of an anticipated general election in 2024.

Inflation aside, the economic picture remained mixed. Data released in May showed that the UK achieved Gross Domestic Product (GDP) growth of 0.1% in the first quarter of the year. Whilst economic activity is widely forecast to have contracted through Q2, at least in part due to the extra bank holiday to mark the coronation, it means the UK is now likely to avoid a technical recession this year (defined as two consecutive quarters of negative GDP growth). The UK services purchasing managers index (PMI) fell to 53.7 in June, but remained north of 50, extending the growth trend for UK service providers to a fifth straight month. In contrast, June’s report on UK manufacturers painted a far less rosy picture, with growth declining for the eleventh consecutive month, accompanied by a sharp decline in new orders.

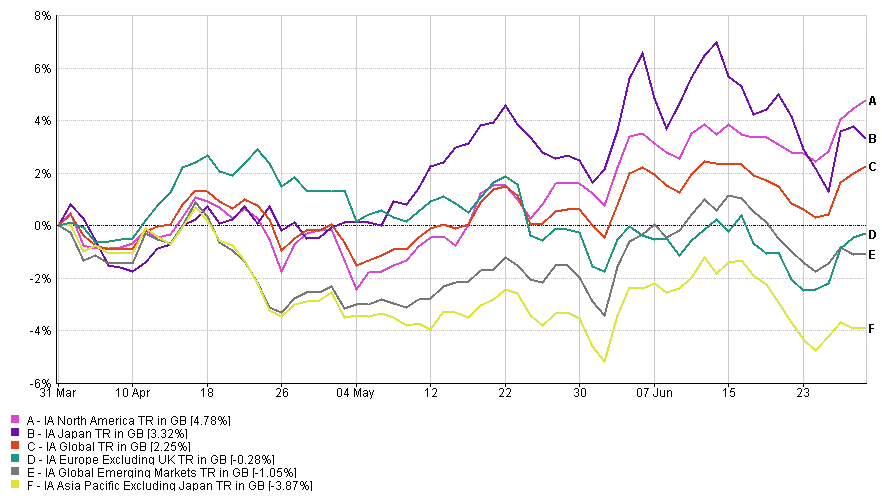

Global Equities

Q2 was a mixed month for global equities, with AI-driven enthusiasm supporting gains for those markets with greater technology exposure. Following a strong rally in Q1, Chinese equities were amongst the worst performing through Q2, as the optimism surrounding China’s reopening seen earlier in the year began to fade in the face of disappointing economic data and weakening demand.

Following a disappointing first quarter, US equities were the best performing market through Q2. That said, the rally was extraordinarily narrow, with the ‘super seven’ mega-cap technology stocks (including Nvidia, and other AI beneficiaries such as Google and Microsoft) accounting for virtually all of the positive performance of the aggregate index. The remaining 493 companies were roughly flat over the quarter. In May, headlines were dominated by the US debt ceiling impasse. The debt ceiling, which imposes a limit on how much the Federal government can borrow ($31.4tn at the start of Q2), is raised or suspended every few years, but to do so requires a vote by US Congress. With US politics increasingly divided, and President Biden’s Democrats now a minority in the house, the inability to agree on a deal risked an unprecedented debt default by the US government, a move that would have sent shockwaves through the global financial system (US Treasuries are generally considered ‘risk free’). In early June, just days before the US was officially due to ‘run out of money’, a deal was reached, one which will see the debt ceiling suspended (i.e., no cap at all) until 2025.

In stark contrast to the UK, US inflation showed the first signs of returning towards a more ‘normal’ range, continuing its steady decline from last summer’s peak. At the time of writing, headline CPI (May data) is 4%, less than half our own figure. With inflation subsiding, the Federal Reserve (the Fed) increased rates again in May, before announcing a pause to a cycle that began 13 months earlier. In their June policy statement, Fed officials signalled that they would now give themselves time to assess how the economy reacts to the new higher rate environment. To date, the answer appears to be ‘pretty well’, with economic indicators such as consumer spending and unemployment data proving resilient. However, with the full effect of higher rates typically not felt for at least 12 months, significant uncertainty remains.

Following two consecutive quarters as the best performing major region, European equities lagged other developed markets through Q2. In May, revised figures showed that the German economy failed to avoid a recession over the winter, with a decline in GDP of 0.5% in Q4 2022 followed by a revised fall of 0.3% in Q1 of this year. The energy outlook remains complex – much was made of the resurgence of European equities through Q1, as mild weather and rapidly declining natural gas prices meant the worst-case scenario of widespread energy shortages was largely avoided. However, with the war in Ukraine ongoing with little sign of a resolution, some analysts are already warning of a repeat scenario next winter, particularly if the weather is less favourable. On a related note, German power prices hit a record low minus (yes, minus) 500 MWh last week, as the country’s grid was flooded with excess wind and solar power – a sign of things to come as the European Union pursues its aggressive roll-out of renewables capacity.

After years of underperformance relative to other developed markets, Japanese equities have flourished this year, with both flagship indices hitting levels not seen since the late 1980s. Like other developed markets, Japan is experiencing a period of elevated inflation. However, at 3.2% in May, inflation is arguably at a healthier level now than it has been for many years, with the Japanese economy historically dogged by long periods of deflation. There is a cyclical element to the recent outperformance as well, with the Japanese economy relatively late in reopening following the pandemic. The third and perhaps most important recent development was a new initiative from the Tokyo Stock Exchange (TSE), announced earlier this year, which calls on companies to focus on achieving sustainable growth and enhancing corporate value. In particular, the TSE has targeted those companies with relatively low valuations, a move which proved to be a powerful tailwind for the more ‘value’ orientated segments of the market.

Chinese equities generally disappointed through Q2, with the exception of a handful of technology stocks caught up in the excitement surrounding AI. Chinese indices enjoyed a strong start to 2023, as the roll-back of strict zero-COVID policies prompted hopes of a strong rally for the domestic economy. This optimism proved short-lived, however, as disappointing economic data and weakening demand weighed on investor returns. Mirroring the trend seen across several developed markets, service sector activity continued to grow (albeit at a weakening pace), however the real disappointment was manufacturing, which delivered a third straight month of contraction in June. With the recovery sputtering, pressure is increasing on Chinese policymakers to shore up growth through the second half of 2023, with further rate cuts and other economic stimuli widely expected.

The underperformance of Chinese equities dragged down the overall performance of major global emerging market indices through a broadly positive quarter for the smaller constituents. India was amongst the strongest performers, returning over 9% through Q2, as encouraging economic data boosted sentiment. There were strong gains too for tech-heavy markets such as South Korea and Taiwan, both major beneficiaries of the enthusiasm surrounding AI. Taiwanese companies alone account for approximately 50% of global semiconductor manufacturing capacity, making the country a major enabler of current and future developments in the burgeoning sector. Major oil exporting markets were more mixed, with Saudi Arabia’s surprise voluntary production cut failing to halt the recent slide in global crude prices.

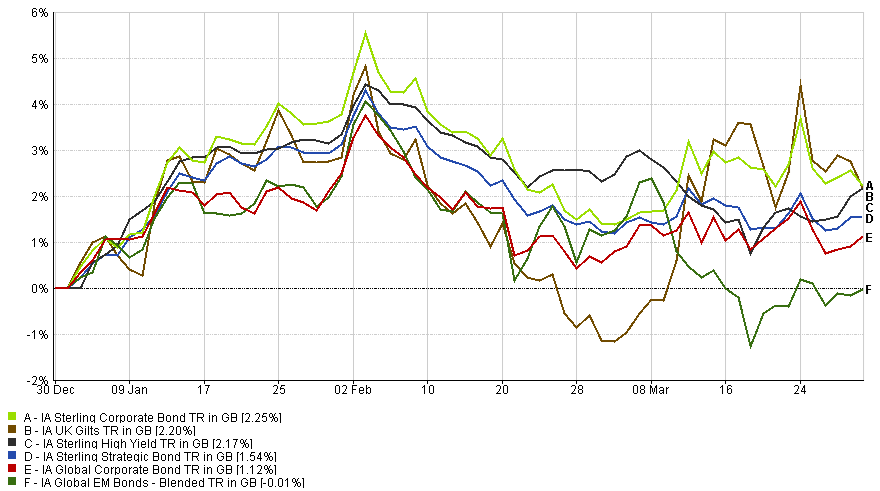

Fixed Interest

It was another challenging quarter for bond investors, with the aggregate global bond index slumping to a 4% loss in sterling terms. At the outset of 2023, the bond market was enjoying a level of optimism not seen since prior to the global financial crisis, as the precipitous fall in prices through 2022 pushed yields to multi-decade highs. However, with inflation once again proving stickier than expected – particularly in the UK – terminal interest rate expectations were pushed higher still (as rates rise, bond prices fall). As a result, the original optimism has yet to be realised in terms of investment returns.

The quarter was particularly disappointing for investors holding sterling denominated bonds, as disappointing inflation data piled pressure on the BoE to raise rates beyond previous expectations. When the BoE announced a 25 bps hike in mid-May, many expected the Bank to pause its hiking cycle, in line with policymakers in the US. However, following June’s CPI report, which showed no reduction in inflation through the month of May, the BoE responded with a 50 bps hike, pushing the base rate to 5%. The last time rates were above 5% was April 2008, and market forecasts for the terminal rate are now a full 1% higher than they were at the start of Q2. Reflecting the macroeconomic backdrop, the best performing sterling assets were those with the lowest overall duration (lower sensitivity to changes in interest rates), most notably sterling high yield, where the high interest payments outweighed the fall in value of the underlying bonds. For the second consecutive quarter, aggregate UK gilts were the worst performing sub-sector, with the yield on a 10-year government bond rising 1% to finish the month at 4.39%.

Yields also crept higher in the US where, despite the Fed pausing its rate hiking cycle, policymakers retained a hawkish (preferring higher rates) tone. While the US inflation outlook is decidedly more positive than here in the UK, growth in the services sector, as well as continuing wage pressures, continued to demand the attention of Fed officials. Markets now expect a further 25 bp hike in July, though the Fed has stressed that the decision will be largely data-driven. The US yield curve remains inverted (i.e., the yields on short-dated bonds exceed those on longer dated bonds). The yield on the 2-year Treasury finished the month at 4.9%, rising 0.9% over the quarter, while the yield on the 10-year rose by 0.4% to finish June at 3.8%.

The European Central Bank (ECB) also signalled that it has further to go in terms of raising rates, with policymakers on the continent particularly concerned about core inflation (a complimentary measure of inflation with the effects of food and energy stripped out), which at the time of writing sits at 5.4% (June reading). With these rate increases largely priced in by markets, government bond yields crept up only slightly through Q2, with the yield on the 10-year bund (German government bond) rising 0.1% to end the quarter at 2.4%. It is worth noting that, much like the US, European homeowners typically fix mortgages over much longer periods than here in the UK. As a result, few European consumers are yet to feel the pinch of higher rates.

Commercial Property

Despite UK interest rate expectations being revised substantially higher through Q2, the UK Direct Property sector continued its slow recovery from a period of marked underperformance last year. However, due to the way in which open-ended funds are valued, the impact of higher rates may yet feed through into lower asset prices as we enter Q3. The immediate impact of higher rates was felt in the listed property sector, with aggregate UK real estate investment trusts (REITs) declining c.8% over the quarter. Many of these REITs are now trading at historic discounts to their underlying net asset value (NAV). While the impact of higher rates is clearly a headwind for the sector, other indicators were more mixed. For instance, in the retail sector, UK footfall in May was 3.3% higher than the same month in 2022, while retail capital values grew 0.16% month-on-month. Likewise in the industrial sector, both rental and capital growth indices showed small month-on-month gains. Meanwhile, in the residential sector, the average UK house price defied expectations in June, rising 0.1%. However, prices remained 3.5% lower than 12 months earlier, and with two-year fixed mortgage rates now exceeding 6%, building society Nationwide is predicting elevated rates to ‘exert significant drag’ on market activity in the months ahead.

Commodities

Commodities were the best performing asset class through a volatile 2022, however Q2 saw the aggregate index give up further gains, falling 5.4% (in sterling terms), after a similarly bruising Q1. Brent crude fell 6% over the quarter, despite a voluntary production cut of up to 1 million barrels per day by Saudi Arabia, with Russia, the third largest producer, largely expected to follow suit. Following further falls in April and May, the price of natural gas rallied in June to end the quarter 3% up, driven by higher than expected electricity demand and increasing competition for long-term Liquified Natural Gas (LNG) supplies. Following a strong Q1 and a new all time high, the price of gold declined through Q2, as the prospect of further Fed rate hikes increased the attractiveness of the US dollar as the safe-haven asset of choice. Industrial metals were also down, as the market moved to price in weaker-than-expected demand from Chinese manufacturers.

Cash

With central banks continuing to increase rates, the attractiveness of cash as an asset class continued to grow through Q2. However, a significant disconnect now exists between the rates charged by banks on loans (including mortgages), and those paid out in interest (for instance on current accounts). For this reason, we continue to favour money market instruments, which offer a similar return profile to cash, but with a significant yield pick-up versus funds held on deposit.

Whitechurch Investment Team

Quarterly Review, Q2 2023

(Issued July 2023)

FP3558.07.07.2023

Click here to download a PDF Version of the Quarterly Review

Source: Financial Express Analytics. Performance figures are calculated from 01/04/2023 to 30/06/2023 net of fees in sterling. Unit Trust prices are calculated on a bid-to-bid basis OEICs, Investment Trust and Share prices are calculated on a mid to mid basis, with net income reinvested. The value of investments and any income will fluctuate and investors may not get back the full amount invested. Currency exchange rates may affect the value of investments.

Important Notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.