NEW CONTENT: Quarterly Review - Q4 2023

9th January 2024

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

Capital Gains Tax Changes: You may be aware that in the March 23 Spring Budget the Government announced changes to the Capital Gains Tax (CGT) allowances available. From the 6th April 2024 the CGT annual exempt amount (amount of capital gains tax you can incur before having to pay tax) for individuals will decrease to £3,000. If you have investments held outside an ISA or Pension account, or if you have subscribed to ‘auto-ISA’ to complete your ISA subscription from your general investment account you may be affected by this reduction in Capital Gains Tax allowance. If you are unsure of your position or you need information or advice on this matter please speak to your adviser.

Macro & Markets

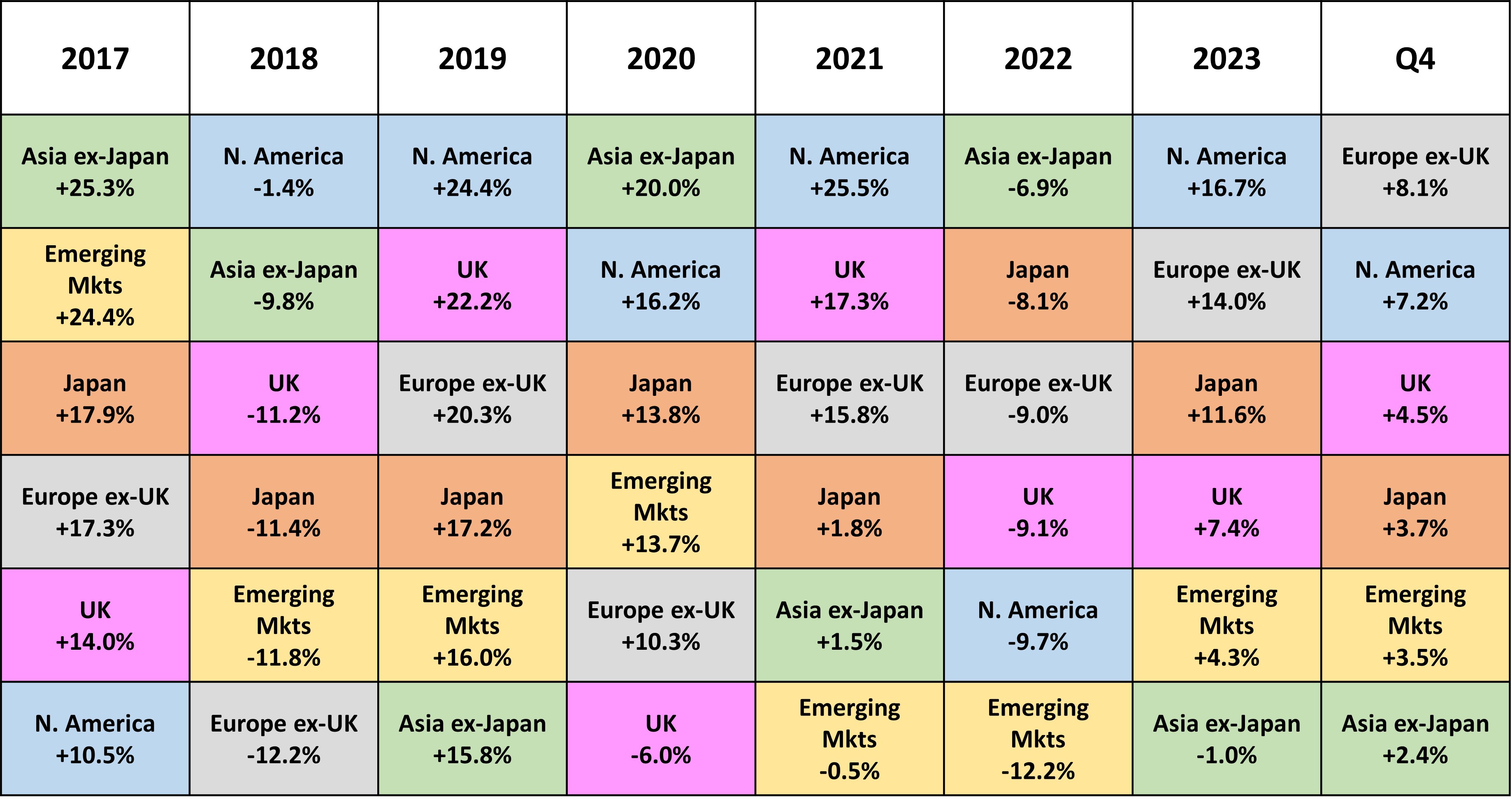

Major market total returns in Sterling. Data correct as of 01/01/24. Sectors used: Asia ex-Japan – IA Asia Pacific excluding Japan TR (GBP), Emerging Mkts – IA Global Emerging Markets TR (GBP), Europe ex-UK – IA Europe excluding UK TR (GBP), Japan – IA Japan TR (GBP), N. America – IA North America TR (GBP), UK – IA UK All Companies TR (GBP).

Market movements in Q4 were dominated by familiar factors, with the increasingly encouraging inflation narrative a key driver of returns through another volatile quarter for equity and bond investors. October began with markets in risk-off mode – in the US, despite a rapid fall in inflation since the summer of 2022, September’s Consumer Price Index (CPI, reported in October) was marginally higher than market expectations. Above target inflation, coupled with the release of some very strong economic data, led to fears that interest rates would have to remain higher for longer, dashing prior expectations that the Federal Reserve could begin cutting rates in the first half of 2024. This change of mentality led to a sharp sell-off in equities and bonds, with the yield on the 10-year US Treasury briefly passing the symbolic 5% mark. The most rate sensitive areas of the market, including clean energy stocks and renewable infrastructure assets, were particularly hard hit.

November saw a sharp reversal of October’s fortunes, with markets buoyed by tentative signs of economic moderation in the US, as well as encouraging inflation data on both sides of the Atlantic. Headline US inflation dropped to 3.2%, easing fears that the Federal Reserve would raise rates once more before the end of the year. With the jobs market also showing signs of cooling, bonds rallied sharply, with the yield on the 10-year Treasury falling more than 50 basis points (bps) to end the month at 4.4%. Equities also enjoyed a strong month, with technology stocks and other rate sensitive areas of the market amongst the best performers.

The UK also saw a larger than expected decline in inflation - headline CPI fell sharply to 4.6%, driven by housing/household services and declining energy prices. With Q3 gross domestic product revised down to -0.1% and the UK economy seemingly on the verge of a shallow recession, it appears that the impact of higher rates is already being felt. While wage growth remains elevated, the Bank of England signalled that it was likely done raising rates, though it cautioned that the prospect of rate cuts remains some way off.

Positive sentiment continued into December, with investors’ hopes of a so-called ‘Santa rally’ largely fulfilled due to further encouraging inflation data, and the subsequent decline in bond yields. UK equities, for much of 2023 the laggards amongst developed markets, enjoyed a particularly strong month, as the publication of November’s inflation data showed another steep decline in headline CPI. Smaller companies were amongst the best performers, with the UK mid-cap index up over 8%, as falling bonds yields provided a boost for more domestically orientated areas of the market.

Moving on to markets where despite a challenging October, all major regions ended the quarter firmly in the black (all returns in sterling). The best performing major region was Europe (ex. UK) where, despite some rather gloomy economic data, inflation fell back to within touching distance of the European Central Bank’s (ECB) 2% target, with prices rising just 2.4% in November. With natural gas storage facilities close to full and wholesale prices back to levels not seen since 2021, the bloc also looks well positioned to weather another winter cut-off from Russian oil and gas.

US investors also enjoyed strong returns. Much has been made this year of the outperformance of the so-called ‘Magnificent Seven’, the group of mega-cap technology stocks that includes Apple, Microsoft and Nvidia. Despite a mixed Q4 in which Tesla and Alphabet (Google) underperformed the wider market, all finished the year at least 20% ahead of the index, with Meta (Facebook) and Nvidia both producing three-figure returns. Aggregate UK and Japanese equities returned 4.5% and 3.7%, respectively, with the latter negatively impacted by currency fluctuations as the yen strengthened versus sterling. Asia ex-Japan and emerging market indices were once again the laggards, largely due to the inclusion of China, where geopolitical uncertainty and ongoing weakness in the goliath real estate sector continued to weigh on domestic equities despite a series of more positive economic data.

Across fixed income, longer duration assets (i.e., those more sensitive to changes in interest rates) broadly outperformed. The sharp drop in UK headline inflation saw gilts outperform corporate bonds, producing a total return of 8.3%. However, after a punishing 18 months, the asset class is still down c.25% over three years. Sterling high yield, a sub-sector generally considered less sensitive to changes in rates, underperformed investment grade but still returned a healthy 5.6% over the quarter. Elsewhere, European government bonds also outperformed, as the weakening economy raised hopes that the ECB will be forced to cut rates in the first half of 2024.

Rate sensitivity was also a key factor across property and alternatives. Following a challenging October during which higher rates continued to weigh on the whole sector, Real Estate Investment Trusts (REITs) enjoyed a particularly strong November/December. Of note was the November performance of the beleaguered renewable infrastructure sector, with names such as Gresham House Energy Storage (GRID) and JLEN Environmental Assets rallying to double digit monthly gains after an exceptionally challenging year-to-date.

Asset Allocation & Portfolio Activity

After a year of relatively subdued activity, the evolving interest rate narrative and differences in the economic outlook across developed markets prompted a number of portfolio changes.

Please note that the following discussion is not an exhaustive list of changes made and due to the individual model mandates, changes discussed may not apply to every Whitechurch portfolio – for full details on activity within a specific strategy, investors should revert to the fact sheet.

Equities

Despite the strong performance of global equities through Q4, we remain cautious on the outlook for the asset class. In the US in particular, large-cap stocks look richly valued, reflecting the growing market consensus that the US will avoid a recession. However, these lofty valuations could make these stocks vulnerable if earnings growth slows over the next 12 months. In contrast, the UK market continues to look attractive from a valuation perspective, however we acknowledge that this has been true for several years. With no obvious catalyst for a reversal of the discount to global equities, and the UK economy starting to feel the impact of higher rates, we trimmed our overall UK allocation. Capital was recycled into our global and fixed income allocations, depending on the objectives and risk of each individual strategy.

Back in Q2, we moved to an overweight position with respect to Japanese equities, based on what we saw as a healthy level of inflation and a series of corporate reforms aimed at improving shareholder returns. In our view this investment case for Japan remains intact, and so we retained our overweight position through Q4.

The impact of higher rates is already being felt in the UK and Europe, and while the US economy has proved remarkably resilient, there are some signs that it is starting to cool. In our view, a shallow, albeit potentially drawn out, downturn still looks likely on both sides of the Atlantic. With that in mind, we continue to favour quality, preferring companies and funds with a focus on resilient earnings.

Fixed Income

With yields approaching multi-decade highs through mid-October, we took the opportunity to increase our fixed income allocation across the portfolios. The increase was most pronounced across the lowest risk strategies, where we looked to take advantage of the attractive yields on offer at the expense of equity and alternatives allocation. This proved beneficial through November and December, as a series of encouraging inflation data saw bonds enjoy a pronounced rally.

Since early 2022, we have favoured shorter duration (lower interest rate sensitivity) assets. Whilst the case for owning longer duration assets has strengthened (many of our underlying fund managers are increasing the overall duration of their portfolios), we still see significant value in short-dated bonds which provide a very attractive yield without the volatility of longer-dated instruments. Where portfolio mandate allowed, we also increased overall credit quality, which should provide additional protection for the portfolios should company earnings come under significant pressure.

Alternatives & Property

The property and infrastructure sectors have faced significant challenges throughout 2023, as the prospect of interest rates remaining ‘higher for longer’ suppressed asset valuations and pushed many listed investment companies to historic discounts relative to their underlying net asset values. Simultaneously, the open-ended property sector faced a renewed viability concerns with the high-profile closure of two of the largest funds in the sector. With attractive yields on offer elsewhere, we took the opportunity to reduce our open-ended property exposure, instead favouring the absolute return sector (lower risk) or listed REITs (higher risk). We saw Q4’s evolving interest rate narrative as an opportunity to take advantage of historic discounts (to net asset value) on offer in the REIT sector.

Quarterly Outlook

We anticipate further market volatility through Q1 2024. The recent bond and equity rally were driven by growing expectations that central banks will cut rates sharply through 2024. In the US, markets now anticipate the first cut as soon as March, despite the cautionary tone of Federal Reserve Chair, Jerome Powell. It is our view that markets are being overly optimistic – data from previous cycles suggests that the premature cutting of rates can lead to a rapid re-emergence of inflationary pressures. On that basis, we don’t think central banks will begin cutting rates until there are very strong signs that growth is slowing. In the meantime, investors should continue to closely monitor inflation data, and indeed any signals from central banks, as a guide to the direction of travel through Q1 and beyond.

Whitechurch Investment Team

Quarterly Review, Q4 2023

(Issued January 2023)

FP3663.08.01.2024

Click here to download a PDF Version of the Quarterly Review

Important Notes:

This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.Data Protection:

Whitechurch may have received your personal data from a third party. If you invest through us, we may use your information together with other information for administration and to make money laundering checks. We may disclose your information to our service providers and agents for these purposes. We may keep your information for a reasonable period in order to manage your investment portfolios. We record telephone calls, to make sure we follow your instructions correctly and to improve our service to you through training of our staff. You have a right to ask for a copy of the information we hold about you and to correct any inaccuracies. When you give us information about another person you confirm that they have appointed you to act for them; that they consent to the processing of their personal data, including sensitive personal data and to the transfer of their information and to receive on their behalf any data protection notice.