Whitechurch Investment Update: Quarterly Review - Q3 2023

10th October 2023

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

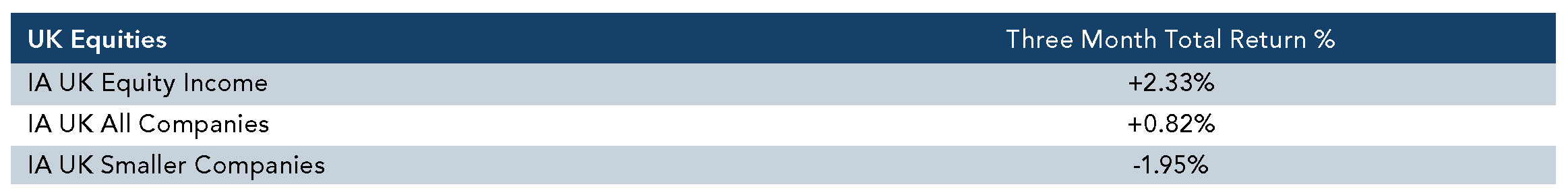

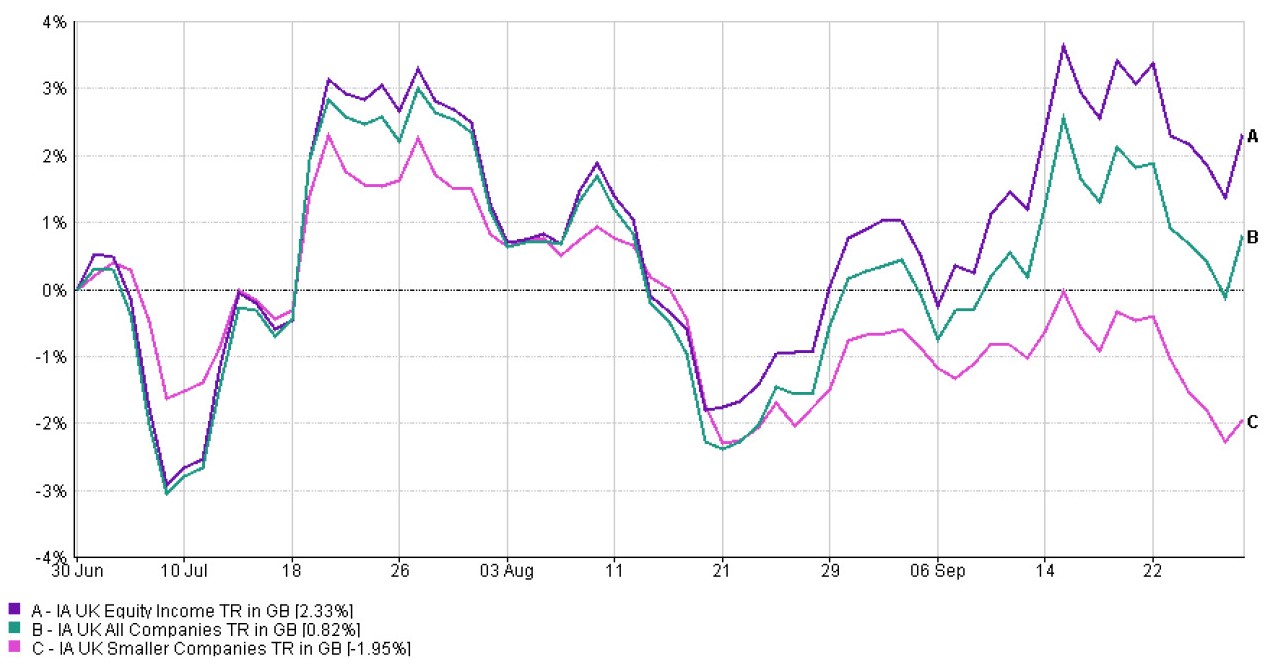

UK Equities

After a disappointing end to last quarter, Q3 saw the wider UK stock market deliver an aggregate return of 0.9%. In what was another mixed quarter, share prices initially recovered some of Q2’s losses during July, with the UK amongst the best performing developed markets. However, widespread volatility in August, thanks in part to rising bond yields and a weakening outlook for the Chinese economy weighing on equities more generally, saw most of the gains chalked off. The return of a more favourable inflation pattern saw markets rally in the final few weeks of the quarter. Not for the first time this year, there was a notable difference between the performance of the major UK indices, with large caps significantly outperforming. The main large cap index returned 2.2%, whilst mid and small-cap indices returned -1.6% and 0.1% respectively. By sector, there were gains for most major asset classes, with energy (+13.9%) the standout contributor, with small losses for consumer staples, consumer discretionary and utilities. However, the most significant decline was seen in the alternative energy sector, which contracted a staggering -58.1% after a series of climbdowns from Prime Minister Rishi Sunak on the country’s net zero commitments.

We reported last quarter that inflation had remained stubbornly high, with a series of inflation surprises weighing heavily on UK markets throughout Q2. By contrast, last quarter offered some reprieve, with a marked change in July’s report, showing that inflation had moved lower than expected, from 8.7% to 7.9%. This seemingly endorsed a continuation of the risk-on theme that has perhaps surprisingly dominated global markets year-to-date. The downward trajectory continued through the quarter with two more consecutive contractions in headline inflation to finish the period at 6.7%. The real talking point was the last core (which excludes the prices of energy, food, alcohol and tobacco) inflation figures of the quarter, which came in at 6.2%, significantly below market expectations of 6.8%. This almost undoubtedly contributed to the Bank of England’s (BoE) decision to hold rates for the first time in almost two years, at 5.25%. However, in what was somewhat of a reality check, economic data remained mixed, if not muted, throughout the period. Whilst wage growth remained strong, both manufacturing and services output were weak, with the latter at its lowest level since January 2021. There was a slight improvement in the former in September though, which showed improvement on August’s 39-month low.

Economic forecasts remained mixed too. Whilst some indicated that the UK is on course to experience five consecutive years of lost economic growth, others were more upbeat, highlighting an improving GDP outlook. Whilst this will largely depend on the timing or source of whichever forecast investors chose to read, there has been a general overall improvement from the worst-case scenarios being projected earlier this year. The consensus now appears to be that the UK may well narrowly avoid a technical recession yet will likely experience a prolonged period of economic stagnation, with relatively slow growth and both inflation and interest rates remaining higher for longer. Whilst the BoE may have decided to hit pause on their rate hiking cycle, there was a cautionary air at September’s Monetary Policy Committee meeting, with five members voting for and four members against the decision. October’s inflation figures will almost certainly be key in determining the direction of travel from here, with the likelihood of further increases still not off the table. Despite widespread anticipation of cuts to UK interest rates in 2024, some remain less optimistic, with the Bank of America predicting that there won’t be any until 2025 due to the UK’s ‘entrenched inflation’.

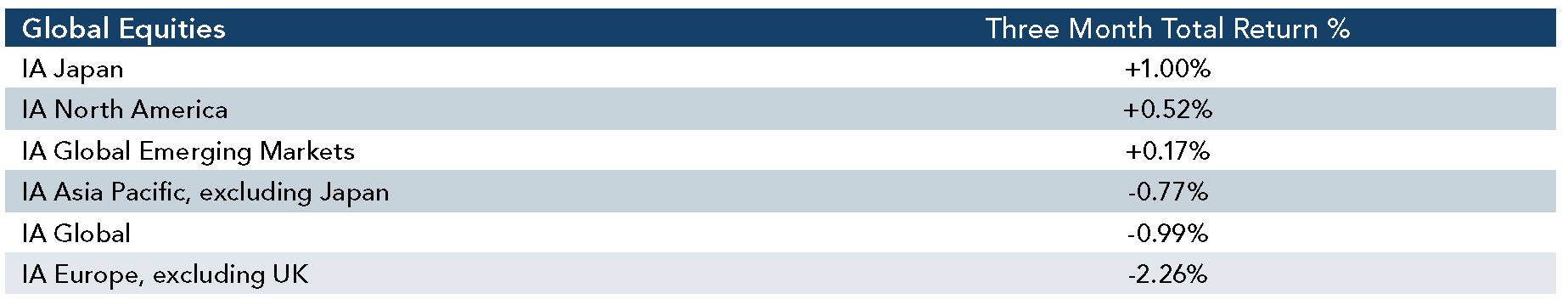

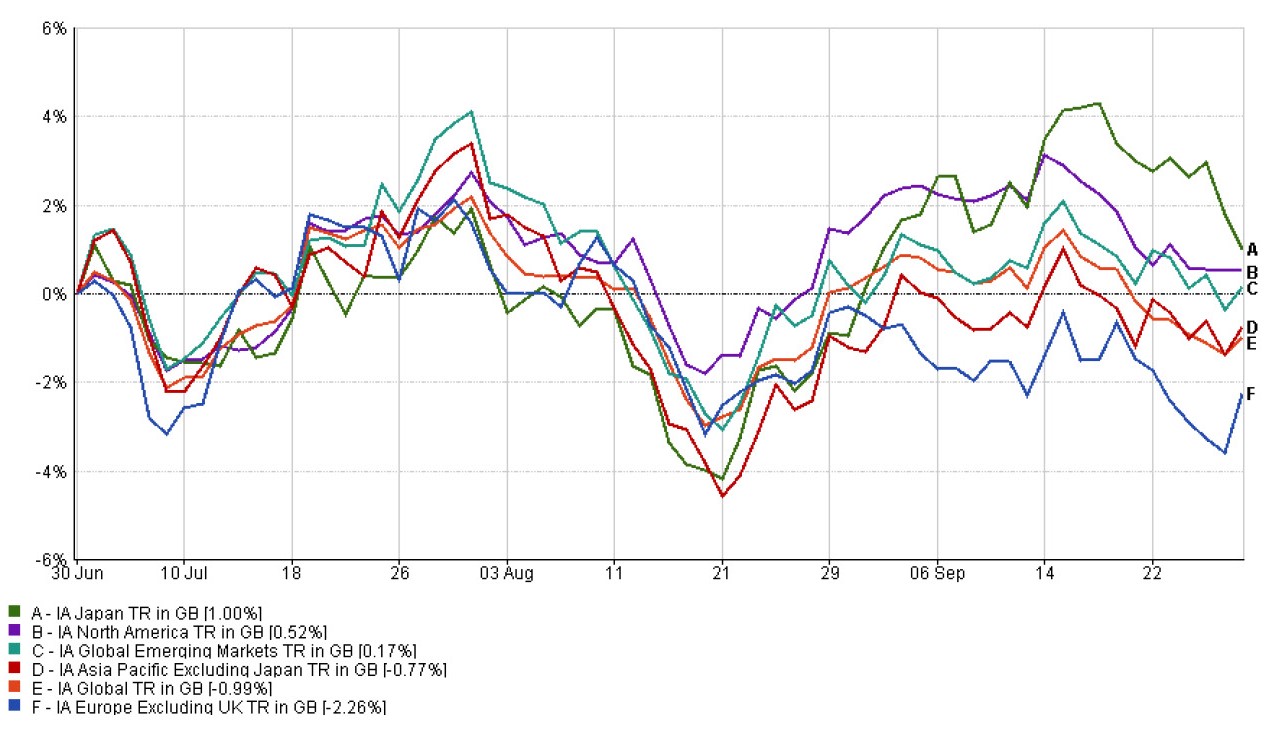

Global Equities

Global equities generally outperformed their fixed income counterparts, however, unlike the first half of the year, the divergence between the two asset classes was minimal during the period. Year-to-date, developed equities have now returned 8.4% versus -3.6% for global bonds, in what has thus far been an environment that has largely favoured risk assets. However, despite many of the themes that drove the performance in the first half of the year persisting, Q3 was far more subdued, with some branding it merely a ‘correction’. There were multiple headwinds at play, such as the return of inflationary pressure from a rising oil price, and a deteriorating picture for the global economic recovery. Decisions from the major central banks were, once again, at the forefront of investors’ minds, as all signs continue to point towards an imminent inflection point in the interest rate hiking cycle. The by-now familiar ‘higher for longer’ rhetoric and concerns over weak economic data pointing to an imminent recession weighed on markets. To this end, we saw a reversal of the outperformance of growth stocks over their value counterparts that had dominated the first half of the year. Despite the continued optimism in the developments of Artificial Intelligence, the prospect of interest rates remaining elevated for some time dampened the sentiment towards stocks reliant on long-term borrowing to meet future growth ambitions.

Despite the figures showing a marginal gain for US equities, this is heavily skewed by the weakness of the pound versus the dollar. In reality, there were widespread losses across the three major US markets during the quarter, with an aggregate return of -2.9%. This was largely down to the fact that after a year of consecutive monthly declines in US headline inflation, August and September saw two increases – the latter relatively sizeable and 0.4% above forecasts. At 3.7% however, this was still low when compared to other developed economies, no doubt helped by the US’ far superior self-sufficiency in energy and food. Core inflation saw a notable reduction to levels not seen since September 2021. As with the BoE, after raising interest rates further in July, the Fed opted to hold rates at a 22-year high at September’s meeting. However, signals that there could still yet be another increase between now and the end of the year undoubtedly burst the bubble of any excitement over the prospect of imminent rate cuts. Towards the end of the quarter, markets appeared to be pricing in four US rate cuts for 2024, versus as many as eight that were being priced in at the beginning of this year. Resilience in corporate earnings continued to allow US equities to trade in a relatively high range, although as with developed markets more generally, economic growth is expected to slow over the medium term from here.

European equities were the worst performing of the major regions, with the most influential French and German markets recording losses of -3.5% and -4.7% respectively. In a similar story to other regions, there were some gains in July before weakening economic data began to weigh heavily over the rest of the period. As was the case in the UK, sectors susceptible to a reduction in disposable consumer income suffered, exacerbated further when the European Central Bank (ECB) raised interest rates twice during the quarter, with the September meeting decision representing the 10th consecutive hike. This came despite eurozone inflation falling to a two-year low, at 4.3%. Manufacturing and services output data remained weak, with employment also declining the most in nearly three years. A survey during the quarter also indicated that business confidence fell to a 10-month low. The mood has been underpinned by the fact that German GDP has now failed to have a positive quarter since Q3 2022, surpassing the technical definition of a recession in the process earlier this year. The ECB also significantly revised downwards its GDP growth projections for the wider region, forecasting economic growth of just 0.7% in 2023, 1.0% in 2024, and 1.5% in 2025.

Japanese equities were once again the strongest performer of the major regions, with the main index returning 1.52%. In fact, except for September, returns have been positive in every month year-to-date, significantly ahead of any other major market. The weakness in the yen has proved to be a tailwind for overseas investors, whilst corporate earnings were broadly in-line or even ahead of expectations. As with the US, rising interest rates continued to pressure growth stocks, with value alternatives proving more resilient throughout the period. Among the winners were financial and energy sectors, whilst technology, in particular the semiconductor industry, was a notable detractor. Japanese inflation finished the quarter at 3.2% – slightly higher than forecast and remaining in the range of the preceding six months. In a policy statement following its September meeting, the Bank of Japan (BoJ) said it would maintain its ultra-loose policy by keeping short-term interest rates at –0.1% for the time-being, citing “extremely high uncertainties” on the outlook for growth both domestically and globally. The period also saw geopolitical tensions with China, following the announcement that water stored at the damaged Fukushima nuclear site would be released into the ocean – a decision predicted to significantly impact tourism demand from China and surrounding areas.

There were marginal losses for Chinese equities during the period, with most other Asian markets also registering weak numbers. Significant damage occurred in August, when concerns over China’s property sector (which accounts for more than one third of the country’s GDP) resurfaced in the headlines again. Volatility continued into September which ultimately resulted in the suspension in trading of property giant Evergrande. We have previously reported how, despite the government remaining supportive, the reopening of the Chinese economy has stalled thus far, with investors unsure whether policy will be enough to restore sentiment in the region. Measures have included the cutting of both interest rates and stamp duty paid on stock market transactions in an attempt to boost activity and confidence. As global economic growth prospects continued to weaken throughout the quarter, there is growing concern that there will be less of a demand for goods, causing serious repercussions for things like Chinese factory production. Elsewhere, data and performance were also poor in Hong Kong, Taiwan and South Korea, whilst some reprieve for the region came from India and Malaysia – two touted potential beneficiaries of the recent ‘onshoring’ (that is the prospect of business operations being relocated away from one country or region to another) theme.

In part due to the significant weighting of China in the index, emerging market equities also experienced a volatile and mixed quarter. To put this into perspective, China makes up 30% of the index, followed by Taiwan (15%), India (14%) and South Korea (12%), before the next largest constituent, Brazil, accounts for just 5%. Whilst registering strong returns during July, the asset class finished the period relatively flat. As with other regions, the headwinds were a familiar story here too, with the prospect of interest rates remaining high over a prolonged period, the slowdown in global economic growth and concerns over China all weighing on performance. As is usually the case with this diverse asset class, returns were highly varied across the board. In addition to most Asian constituents, poor performance came from Chile, Mexico, Poland, and Saudi Arabia, whereas strong contribution came from Columbia, Czech Republic, Egypt, Hungary, India, Turkey and UAE. Despite being the recipients of many favourable write-ups from large global asset allocators at the beginning of the year, emerging markets have significantly underperformed developed markets year-to-date. Part of the logic was that given the regular occurrence of highly varied inflation, emerging governments would be more adept to controlling prices and that consumers would be more used to the conditions.

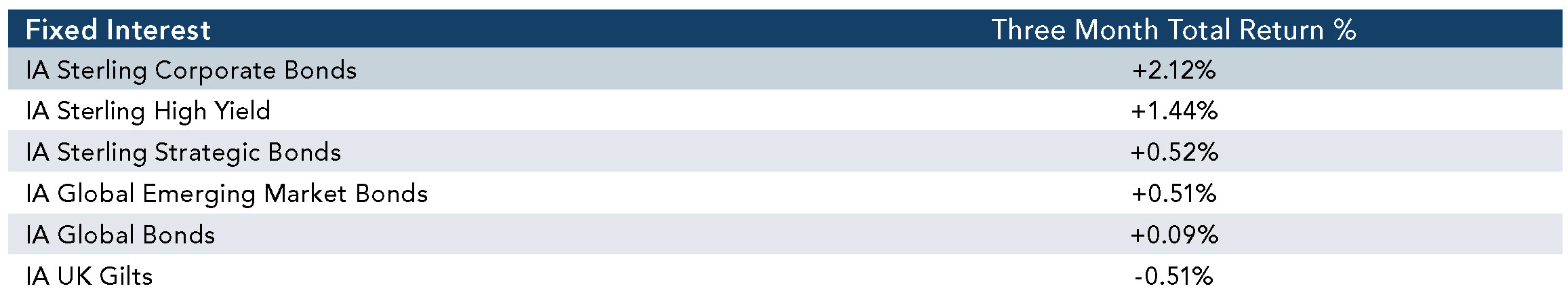

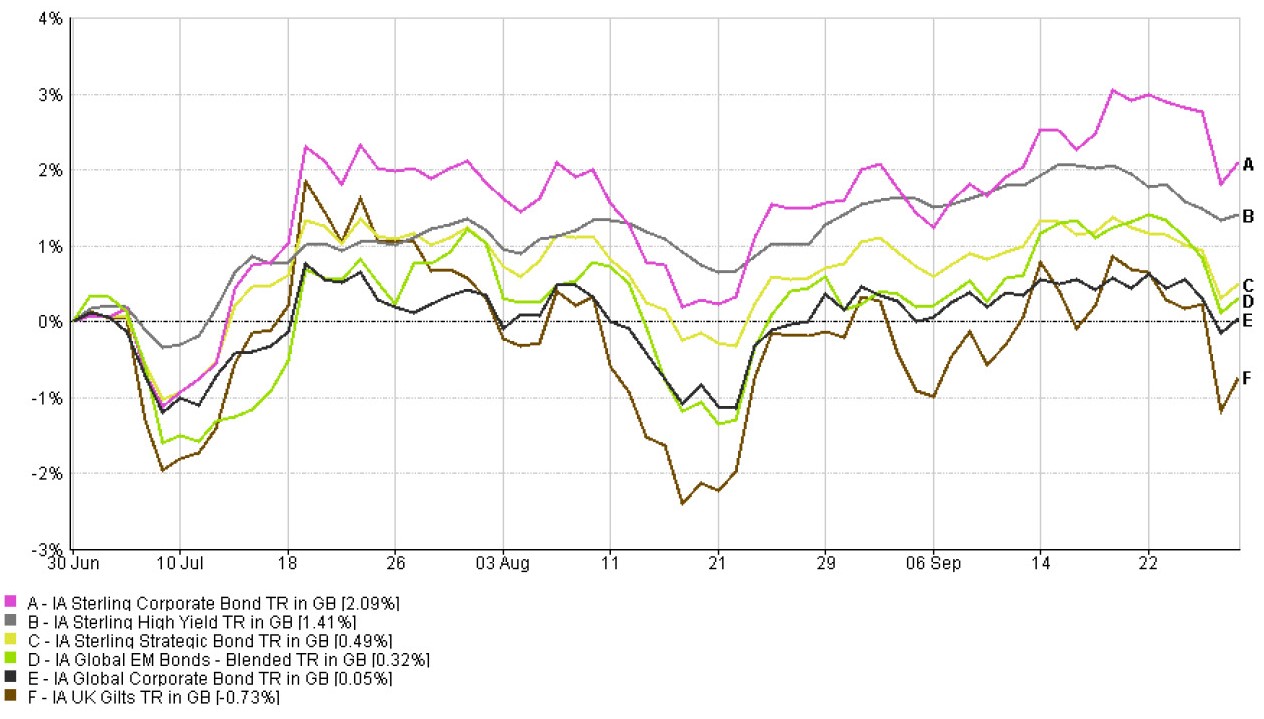

Fixed Income

Bonds marginally underperformed equities, however returns were varied across the asset class. The lack of divergence between equities and bond performance during the period will no doubt have reminded some investors of last year’s correlation, when the two traditionally negatively correlated asset classes appeared to move in lockstep for much of the year. Q3 saw somewhat of a sell-off in global bond markets. Worry over the increasing issuance of US debt weighed on treasuries, with the quarter also seeing a historic downgrade of the US’ triple-A credit rating. The decision was made by a major ratings agency, who said that it reflected expected fiscal deterioration over the next three years, a high and growing government debt burden and an erosion of governance over the last 20 years, which had led to repeated debt limit standoffs and last-minute resolutions. It was an eventful period for the US government, which ended September on the verge of a federal shutdown. The yield on the US 2-year and 10-year government bonds rose (meaning prices fell) from 4.87% to 5.05% and from 3.81% to 4.57% respectively. There were losses elsewhere too, with increases in the 10-year government bond yield in Germany, Japan and the UK. Gilts continued their dismal run, in a period that marked the one-year anniversary of the ‘mini-budget’ fiasco.

Corporate bonds tended to outperform, with high yield marginally ahead of their higher credit quality investment grade counterparts. The inverse relationship of rising rates with bond prices has acted as a major headwind for the performance of fixed income over the last 18-months, leading some investors to allocate away from bonds and instead opt for the relative security and diversification offered by alternatives or take advantage of attractive rates offered by cash or money market accounts. Given the trajectory of the yield curve and lack of long-term clarity for much of this period, bonds with a higher duration (sensitivity to changes in interest rates) have generally fared worse than their lower (typically those with a maturity between 0-3 years) duration counterparts. In theory, for every 1% increase or decrease in interest rates, a bond's price will change approximately 1% in the opposite direction for every year of duration. This is particularly significant given that central banks of some major economies appear to be signalling the end of their interest rate hiking cycle. The anticipation is that, as inflation comes down, rates will be cut, thus presenting an environment where higher duration bonds may perform better. Bond investors might also be hoping that the recent sentiment shift from inflationary to recessionary will induce a more risk-off environment that could see the traditional diversification and protection benefits of bonds prevail again.

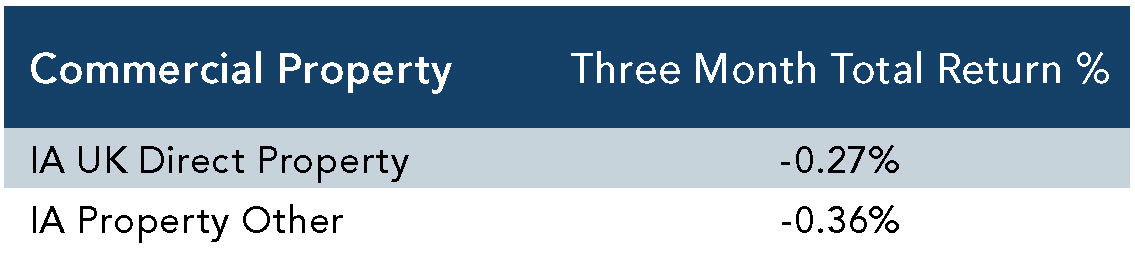

Commercial Property

Both major sectors of the UK commercial property market registered a marginal decline, albeit with far more volatility from listed property securities. Year-to-date, the latter, which includes Real Estate Investment Trusts, have underperformed their bricks and mortar counterparts by circa 5%. Unsurprisingly, the Royal Institute of Chartered Surveyors’ (RICS) latest economy and market report is dominated by talk of elevated interest rates and the associated impact this could have on the property sector. It summarises that data suggests a continuation of the subdued activity and that the thus far resilience shown in the residential property market is likely to fade. The report highlighted that commercial UK property transactions during the second quarter of this year were 41% lower than the five-year average, with the office sector – a natural casualty of hybrid working arrangements – the major laggard. Despite headline property valuations already suffering a notable decline towards the end of 2022 and in the first quarter of this year, the report details that more than 70% of respondents to the latest RICS confidence survey still believe the sector to be in a downturn. There were some positive takeaways, such as an expectation that construction activity will grow over the coming year, led by workloads in the infrastructure sector.

Commodities

After a muted first half of the year, commodity prices experienced a sharp increase during Q3, with the aggregate composite index moving 15.4% higher, taking year-to-date returns into positive territory. The main talking point was the price of oil, which spiked 28% following Russia and Saudi Arabia’s decision to cut production, finishing the quarter above $92 per barrel (Brent Crude) – its highest since November 2022. The rally in the oil price was in part responsible for energy being the best performing component of the commodity market, despite a decline in the natural gas price. As many regions remain largely dependent on gas from Russian sources, investors will be mindful that we are heading into winter, which will likely change the demand dynamic. Given the concerns over global economic growth prospects and what it might mean for the manufacturing industry, investors’ attention also focused on industrial metals for some sort of gauge. Returns were mixed, with decreases in the prices of copper and nickel, but gains for aluminium, lead and zinc. The most notable losses came from precious metals and agriculture industries. The US dollar, which is often a major factor for the direction of commodity prices given its inverse relationship with raw material prices, edged higher during the quarter.

Cash

Given the economic backdrop and the resultant upward move in fixed income yields, the case for holding cash remained popular with some investors during the quarter. In the short-term, cash deposits insulate investors from the price volatility seen in other asset markets. However, in the long-term, the real value of cash deposits is likely to continue to be eroded by inflation. We currently only hold cash for short-term tactical reasons or within lower risk strategies, where the risk profile dictates a need for a larger cash allocation. Furthermore, we are mindful that should interest rates come down, it could lead to less attractive deposit rates offered by cash and money market accounts.

Whitechurch Investment Team

Quarterly Review, Q3 2023

(Issued October 2023)

FP3613.10.10.2023

Click here to download a PDF Version of the Quarterly Review

Source: Financial Express Analytics. Performance figures are calculated from 01/07/2023 to 30/09/2023 net of fees in sterling. Unit Trust prices are calculated on a bid-to-bid basis OEICs, Investment Trust and Share prices are calculated on a mid to mid basis, with net income reinvested. The value of investments and any income will fluctuate and investors may not get back the full amount invested. Currency exchange rates may affect the value of investments.

Important Notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.