Quarterly Review - Q2 2024

15th July 2024

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

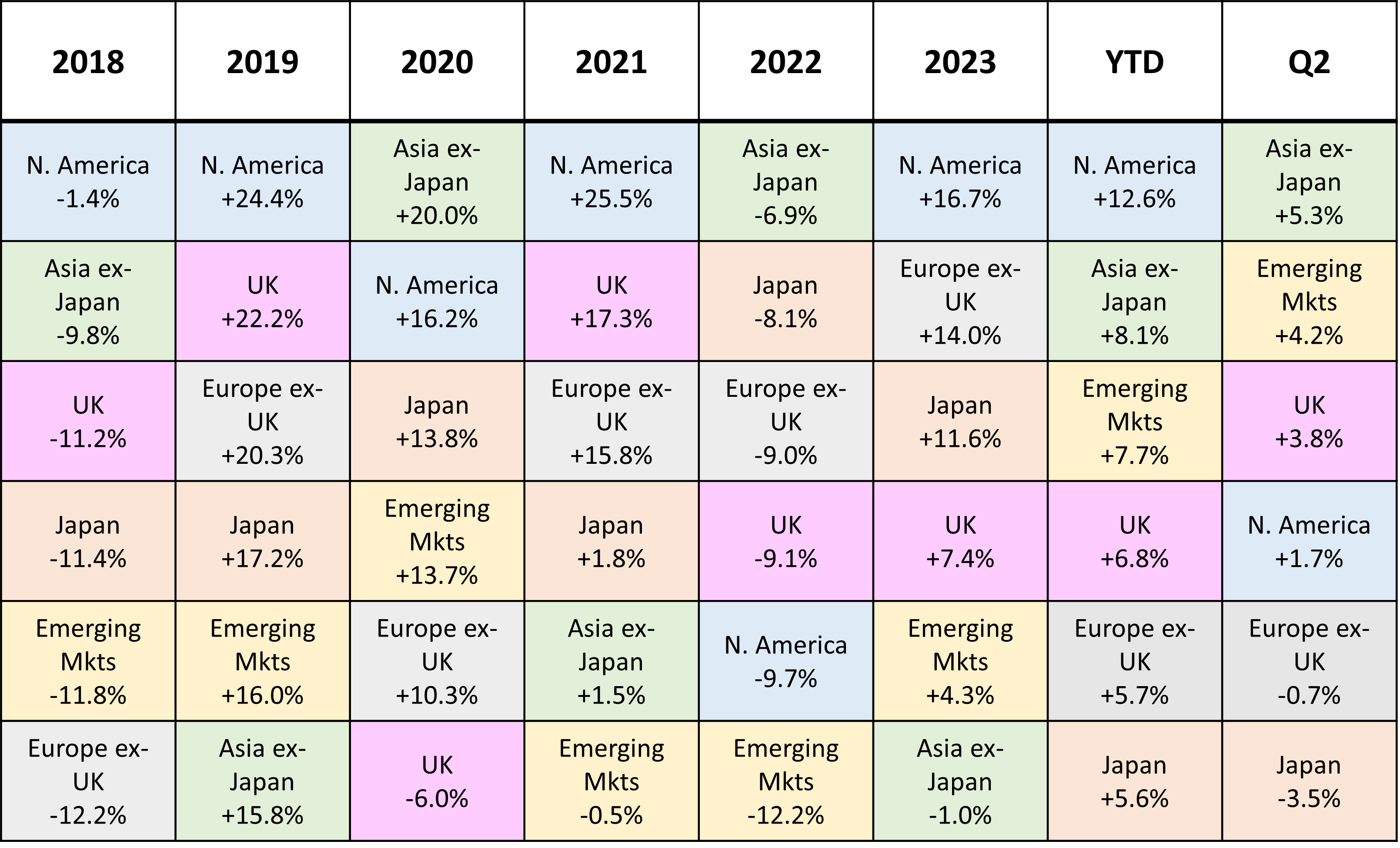

Source: FE Analytics. Major market total returns in Sterling. Data correct as of 01/07/24. Sectors used: Asia ex-Japan – IA Asia Pacific excluding Japan TR (GBP), Emerging Mkts – IA Global Emerging Markets TR (GBP), Europe ex-UK – IA Europe excluding UK TR (GBP), Japan – IA Japan TR (GBP), N. America – IA North America TR (GBP), UK – IA UK All Companies TR (GBP).

Macro

The meaningful divergence between major asset classes that had been a feature earlier in the year once again proved to be short-lived, with return profiles seemingly reverting to a pattern more akin to what investors experienced throughout much of 2022/23. With US headline inflation experiencing a second consecutive upside surprise during the period, expectations for a raft of 2024 interest rate cuts from the US Federal Reserve (Fed) were consequently revised sharply lower, sending equity market volatility to a year-to-date high mid-April, and putting those that had been hopeful of a continuation of Q1s rally on the back foot. The higher for longer rates narrative continued to weigh on fixed income markets too, however, the quarter did feature the first interest rate cut from a major developed central bank since the immediate aftermath of the Covid outbreak, with the somewhat landmark moment coming from the European Central Bank (ECB) in June.

The quarter began amid some major backpedalling – namely, the adjustment from as many as seven US rate cuts being priced in for the calendar year in January, to just two by the beginning of Q2. This largely set the tone for April, along with resilient retail sales and jobs figures released during the month underpinning the sentiment shift. The uptick in US headline inflation figures from 3.2% to 3.5% released during the month understandably dominated headlines, with hawkish language from the Fed during the month also appearing to spook investors. US Treasury yields finished the month markedly higher, with interest rates subsequently kept on hold for a sixth consecutive meeting. Despite a converse trajectory for inflation in both the UK and Eurozone during the month, rates there were kept similarly high too, with the Bank of Japan also opting to keep things on hold, a month on from their historic move to positive rate territory.

Following April’s rerating, downbeat expectations for rate cuts were somewhat cushioned by a slight easing in US inflation in May. Corporate earnings continued their vigour, with Artificial Intelligence (AI) giant Nvidia grabbing the headlines with another set of gangbuster quarterly results, whilst the labour market also largely maintained resilience. Closer to home, both the UK and Europe experienced an improvement in sentiment following confirmation that inflation was heading ever closer to target levels, at 2.3% and 2.4% respectively. This represented a substantial decline from its peak some 18 months prior, when headline figures hit 11.1% and 10.6%. Further afield, despite also experiencing a general improvement in recent sentiment, economic data from China curbed emerging market performance. Retail sales fell well short of consensus expectations, whilst new business loan figures released by the People’s Bank of China showed demand in some sectors close to multi-decade lows.

The quarter ended with confirmation of a further month-on-month softening of US headline inflation, to 3.3%, and whilst household income was stronger than predicted, early indications for consumer spend growth achieved during H1 point towards the c. 1.5% level – a marked decline from 3.2% during H2 2023. Despite Fed policymakers decidedly mixed in their views for when the first rate cut will come, the latest round of data appears to have buoyed hopes for one as soon as September among the investment community. June saw a significant milestone reached in the UK, with figures released in the penultimate week of the quarter showing that headline inflation for May was 2.0% – otherwise known as the government’s long-term target level. Elsewhere, the ECB were busy making headlines with a landmark of their own – the first of the major developed regional central banks to cut, which was delivered in the form of a 0.25% reduction on 6th June. However, a subsequent inflation print showed a tick up back to 2.6%, thanks to rising food and service prices during May.

Equity Markets

Following the broad equity rally at the start to the year, Q2 saw a far tamer and more mixed return set for equity markets amidst heightened volatility. Notably, April saw a reversal in fortunes for Q1s major winners, with US, European and Japanese equities all producing negative (GBP) returns in the first month of the second quarter, with only the UK, Asia Pacific ex-Japan and emerging markets finishing April in the green. As investors revised interest rate expectations, the c. -3% loss for US markets during the month drove down the aggregate returns of global equities, underperforming global bonds in the process. Despite a third consecutive decline in inflation in Europe, manufacturing output showed a deteriorating picture for both business conditions and new orders, whilst the losses in Japan were broadly attributed to profit taking by overseas investors, concern over interest rate disparity with the rest of the developed world and further weakening of the already under pressure currency. As for April’s winners, UK sentiment improved following the more favourable inflation picture, and services output increasing to an 11-month high, whilst a strong month for Chinese equities significantly influenced both Asia Pacific-ex Japan and emerging market returns.

May saw global equities return to positive territory again, with gains for most developed major regions. The US returned to its more familiar downward inflationary pattern, combining with resilient corporate earnings to propel some US markets to all-time highs during the month. UK equities doubled down on their strong performance in the previous month, also reaching record highs, with small caps being another notable beneficiary, returning more than 6%. Despite the rally closing the gap slightly from near record disparity at the beginning of the year, UK equities remained at a significant discount to both US and European equities. European markets were driven higher by the prospect of imminent rate cuts following another decline in inflation, whilst corporate earnings once again proved robust. Investor sentiment towards the region remained relatively strong, with a reported €96 billion of net inflows into European mutual funds during the first five months of the year. Elsewhere, Japanese equities were the only major developed asset class with a negative return for the month, despite some improvement from April’s disappointment, whilst Asian and emerging markets briefly returned to their more familiar position of underperforming developed markets during the month.

June’s favourable macroeconomic data for the US saw strong gains for the region during the last month of the quarter, meaning the region finished Q2 with an aggregate gain of 1.7%. Despite positive inflation news for the UK, markets faltered during June, which saw them give up some of the gains made earlier in the quarter. Regardless, UK equities finished the period with a return of 3.8% - the highest of any developed region. Despite a rate cut for Europe, political instability plagued much of June, with volatility spilling into equity markets – enough to result in an aggregate loss (-0.7%) for the quarter. Japan registered marginal gains but ended the quarter as the biggest detractor within global equities, with a return of -3.5%. One of June’s, and indeed the quarter’s, main talking points within equity markets was the improving sentiment towards China – a significantly discounted market valuation and a raft of government measures aimed at supporting the struggling property sector helping to fuel the relative resurgence. Other standouts during the period were India and Taiwan, with returns in June of 7.7% and 12.7% respectively. As a result, and despite poor returns from Latin America, emerging markets finished the quarter with an aggregate return of 4.2%, significantly outperforming their developed counterparts.

Other Asset Classes

Whilst the aggregate quarterly return for global equities was 0.7%, global bonds lagged, returning -0.1%. As the higher for longer narrative became further entrenched in the mindset of investors, there were widespread fixed income losses early in the quarter. As government yields rose, prices fell, with global government bonds a notable casualty, returning a loss of -2% in April. Global high yield bonds were the best performer over the same period, with a marginal loss of -0.1%. This remained a theme throughout the quarter, with corporate bonds outperforming their government counterparts, and high yield outperforming their higher quality investment grade equivalents. At a regional level, both US and UK aggregate indices outperformed Europe and Japan, which were both detractors during the period, whilst the prospect of investors having to wait longer for meaningful rate cuts ensured that short-duration assets remained attractive for the time-being. The elevated cost of borrowing continued to weigh heavily on other asset classes too, with the listed commercial property sector returning an aggregate quarterly loss of -2%. Infrastructure registered a marginal gain for the quarter but remains in the red year-to-date. Following huge gains in Q1, global commodities returned 0.6% during the quarter, with oil finishing the period just shy of $85 per barrel.

Asset Allocation & Portfolio Activity

As per last quarter, the following discussion is not an exhaustive list of changes made and due to the individual model mandates, changes discussed may not apply to every Whitechurch portfolio – for full details on activity within a specific strategy, investors should revert to the fact sheet.

Equities

Despite another strong quarter for developed market equities, we remain cautious, particularly in the US where valuations in some sectors look stretched, and market cap weighted indices carry a high degree of concentration risk. While passives remain a core part of our US allocation, we chose to increase our active US weighting, increasing exposure to less richly valued segments of the market, including small cap stocks, which continue to trade at a near-record discount to large cap peers. In the UK, we reduced our equity income exposure – the sector has been a useful source of yield for the income focussed portfolios, but with bonds now providing an attractive income, there is greater flexibility to seek capital growth. We mirrored the US move, using the proceeds to increase our small and mid-cap weighting, anticipating that the move towards rate cuts should help close the discount that persists versus large cap peers.

In Europe, we sold out of our income-focussed mandate in favour of a fund with more of a blended investment style. With lower inflation and a weaker economy than other developed markets, we think the European Central Bank could be the first among its peers to cut rates, a move which could be favourable for more growth-orientated areas of the market.

We made no changes to our emerging markets allocation, maintaining a preference for broad geographical diversification. Chinese equities look exceptionally cheap relative to historical averages, but we still see few catalysts for a sustained recovery, while there is a non-negligible risk of the whole region becoming a ‘value trap’. On the flip side, Indian stocks look expensive, but demographics and the macroeconomic backdrop are, in our view, more supportive of future growth. We maintained our preference for owning both regions simultaneously, with the differentiated return profiles providing significant diversification benefit for the higher risk portfolios.

Fixed Income

We entered Q2 with a marginal overweight to fixed income, which had generally been funded from cash or money market assets. This was maintained throughout the quarter, with the redistribution of proceeds from the sale of a UK direct property position, which we exited in May. Despite being comfortable with the management and underlying holdings of the fund in question, we chose to remove the position given concern over growing regulatory pressure within the direct property sector, and a lack of future liquidity for the asset class.

At time of writing, we are broadly at weight with our equity/bond allocation, adjusted accordingly for the given risk band.

Alternatives & Property

Other than exiting our remaining UK direct property position in May, we made no other changes to allocations. We remain invested in listed property, as well as infrastructure and renewable energy. As we wrote last quarter, we continue to favour the absolute return sector as a source of uncorrelated returns with lower volatility than the other major asset classes.

Quarterly Outlook

Global equity markets have continued to exceed expectations, with several major developed indices reaching all-time highs during Q2. With headline inflation now largely under control in the US, UK and Europe, we are at the top of the rate cycle and thus we are cautiously optimistic on the outlook for equities moving into H2. That said, we remain mindful of the risk of further inflation tick ups, as well as just how narrow some markets are. We are also conscious that whilst inflation has generally been moving in the right direction, core inflation (which removes the effect of energy and food prices) has, at times, proved sticky, and at time of writing is higher now in Europe than it was two months ago. As for specific equity markets, the final weeks of the quarter were plagued with volatility, particularly in the US, where AI giant Nvidia, went from the third, to the first, and back down to the third, largest company in the world within the space of a week. Whilst these extremely narrow markets have leant themselves well to passive funds during recent years, we are mindful that this market dominance can also work against investors on the downside, as it did in 2022.

To this end, we diversify with other asset classes accordingly. Our fixed income allocation remains relatively short duration, but we anticipate this lengthening out as we begin to see meaningful rate cuts from central banks. A lower rate environment should also lend itself well to alternatives, such as property and infrastructure, following an extended period of pain. However, the prospect of a raft of US, and indeed UK, rate cuts feels like it could be some way off. Whilst we may see one during Q3, the most recent Fed meeting saw the 19 policymakers firmly divided in their views, with seven predicting one, eight predicting two and four predicted no US cuts for the calendar year. The reality is that central banks have become incredibly data dependent and will likely remain highly reliant on future inflation prints for a steer on when they can announce their first (or in the case of the ECB, their next) cut. The ambiguity appears to also be shared among those trying to predict future GDP growth too, with forecasts regularly being revised up or down depending on the latest data set. Political uncertainty, both locally and globally shows no signs of abating, with H2 likely to be dominated by November’s US election. Whilst the UK will go to the polls this week, the former is almost certainly more significant in the grand scheme of things for investors.

| Whitechurch Securities Ltd Investment Team | July 2024 |

Whitechurch Investment Team

Quarterly Review, Q2 2024

(Issued July 2024)

FP3781.15.07.24

Important Notes: This publication is issued and approved by Whitechurch Securities Limited, a division of Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority (FCA). We have made great efforts to ensure all content is correct and do not accept any responsibility for errors or omissions. All information is intended to be of a general nature, will not be suitable for everyone and should not be treated as a specific recommendation. We recommend taking professional advice before entering into any obligations or transactions. Investment returns cannot be guaranteed, past performance is not a guide to future performance and investors may not get back the full amount invested. Stockmarkets are not a suitable place for short term investments. Levels, bases of, and reliefs from taxation are subject to change and values depend on circumstances of the investor.

Our Environmental, Social, and Governance (ESG) Credentials:

Whitechurch Securities Limited are fully committed to the FCA’s AntiGreenwashing Rules and have a robust process to ensure all our ethical investment strategies are managed to strict mandates. However, as we rely on third party fund managers for the underlying investment decisions, we cannot guarantee that our own ESG criteria are being met 100% of the time, despite our best efforts to do so. Our ESG fund screening, selection, review and ongoing monitoring process is available on our website or upon request.Data Protection: Whitechurch may have received your personal data from a third party. If you invest through us, we may use your information together with other information for administration and to make money laundering checks. We may disclose your information to our service providers and agents for these purposes. We may keep your information for a reasonable period in order to manage your investment portfolios. We record telephone calls, to make sure we follow your instructions correctly and to improve our service to you through training of our staff. You have a right to ask for a copy of the information we hold about you and to correct any inaccuracies. When you give us information about another person you confirm that they have appointed you to act for them; that they consent to the processing of their personal data, including sensitive personal data and to the transfer of their information and to receive on their behalf any data protection notice.

Whitechurch Securities Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register No. 114318.

Registered in England and Wales 1576951. Registered Address: C/o Saffery Champness, St Catherine’s Court, Berkeley Place, Bristol, BS8 1BQ

Correspondence Address: The Old Chapel, 14 Fairview Drive, Redland, Bristol BS6 6PH Tel: 0117 452 1208 Web: www.whitechurch.co.uk